Table of Content

We estimate that homeowners can receive their funds anywhere between 2–7 days after their loan is approved. Hearth’s prequalification application does not affect your credit score. However, once a homeowner applies for a loan directly with a lender, that can produce a hard pull to their credit, depending on the lender.

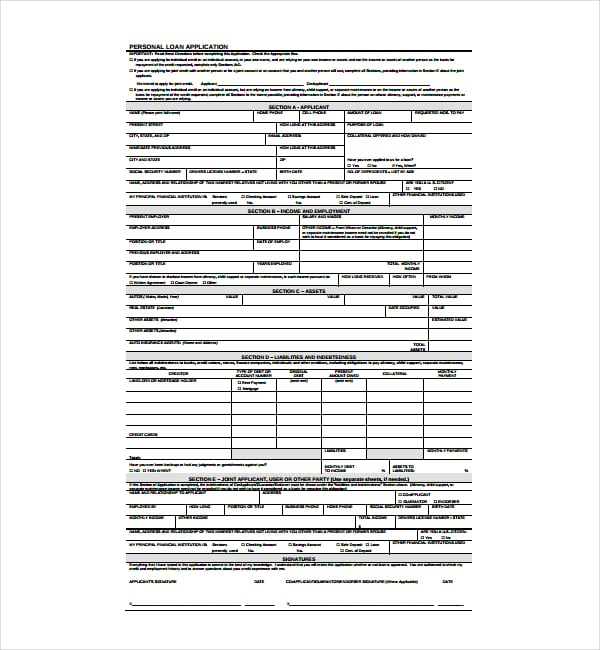

Our lending partners can offer home improvement loans with no collateral up to $100,000 with funding in as little as 1-2 business days . Online lenders are making applying for personal loans even easier, and most consumers should be able to qualify for a personal loan with no problems. Even those borrowers with poor credit have the ability to use a cosigner or co borrower with most major lenders. Using a cosigner or co borrower allows you to take advantage of their high credit score and annual income instead of your own.

Income

Still, the loan amount may not be sufficient to cover the costs of the home improvements you have in mind. The rates can be upward of 30% if you do not have a positive history. It makes sense to compare lenders as they will often have different offers for people in similar financial positions and who need emergency personal loans or longer-term lending like home improvement loans. Your credit rating and even debt-to-income ratio will be considered. There are specific personal loans for fair credit or even poor credit according to the FICO ratings.

This gives you a line of credit based on the value of your home but also uses the house as collateral. The first step for property owners is discovering how home improvement loans work. Learn more about financing a home repair project through traditional and alternative funding.

Best for a Range of Repayment Terms

In other cases, you can secure financing but at a higher than average interest rate. Some lenders are willing to work with borrowers that have poor credit and little to no income, while others are not. To qualify for an unsecured loan like a home improvement personal loan, you will generally need to submit proof of your current income / employment, and have a decent credit score. To access the best interest rates, you should have a prime credit score of at least 660.

We’re transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout life’s financial journey. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy. See our guide on FHA 203k vs HomeStyle loans to see how they stack up against each other and learn more about the complicated process that these loans force you to follow.

They are quick to obtain, often with no start-up fees.

They’re a great way to pay for a smaller purchase when you need some extra cash. And if these don’t apply to your project, there’s likely a better option that you should consider. It’s not uncommon for it to cost $100,000 or more to complete a homeowner’s entire renovation wish list, and this usually means there’s a need to borrow money to make this a reality.

The platform offers unsecured personal home improvement loans from $5,000 to $100,000. You’ll typically need a credit score of at least 670 to qualify for a personal loan. However, if you have excellent credit , you’re more likely to be approved by just about any lender you like—and for better rates, too. And Puerto Rico, and applicants can contact the lender’s customer support team seven days a week; current borrowers have access to customer support from Monday through Saturday.

It won’t get you kicked to the curb like a foreclosure unless the creditor gets a writ of execution from a judge to force the sale of your property, which isn’t likely. To judge whether getting a personal loan for home improvements makes financial sense, you’ll want to consider the size and cost of your project and the amount of equity you have in the home. On top of that, you’ll also want to weigh your comfort level with secured vs. unsecured borrowing. Finally, consider fixed versus variable interest rates, predictable versus flexible dollar amounts, repayment terms and tax benefits. If you are having trouble qualifying for a personal loan, you may want to consider a secured loan. A secured loan involves less risk for the lender, thus allowing them to take more risks.

Writers are separate from our business operation and do not receive direct compensation from advertisers or partners. Checking your rate uses a soft credit inquiry, which does not affect your credit score. If you submit an application, it will result in a hard credit inquiry that may affect your credit score.

Still, a secured loan may be worth considering if you’re confident the monthly payments won’t be an issue as you’ll likely get a lower interest rate. Plus, managing the loan responsibly could help improve your credit score over time if the lender reports payment activity to the major credit bureaus – Experian, TransUnion and Equifax. If you are having trouble keeping up with your debt repayment, you may be able to take advantage of a process known as a debt write-off. Whether or not your unsecured personal loan can be written off or not depends on your lender and your circumstances. There are a few times when an unsecured loan like a home improvement personal loan may be written off.

Home equity loans may be easier to qualify for if you have a poor credit score because you’re using your home as collateral. Personal loans, on the other hand, typically place a heavier emphasis on your credit score, debt-to-income ratio and income. If an unsecured loan is not paid, you can face the possibility of pretty serious consequences. These negative marks can affect your credit score for up to 7 years after the default on the repayment of the loan. Interest rates for unsecured lines of credit can vary widely from lender to lender and depending on your credit score. Mortgages are a type of secured loan since the value of the property you are purchasing is used to back up the loan.

Home improvement loans are unsecured, which means the home is not used as collateral to secure the loan. Alongside loans and lines of credit, you may also be able to use credit cards. However, these are typically suited for smaller home improvement projects, not your $20,000 bathroom remodel. Nonetheless, credit cards can be an excellent way to access a credit limit that you can reuse as you repay your balance. And you’ll only pay interest on unpaid balances at the end of your billing cycle. Home improvement loans have relatively short repayment terms compared to other financing options.

No comments:

Post a Comment